Short-term incentives are the most prevalent type of compensation after salary. Their popularity stems from their versatility and short performance cycles with frequent checks and adjustments, lending STI bonus to be one of the more agile-friendly incentives.

In this article, I dive deep into all you want to know about short-term incentives, including:

Short-term incentives, also known as annual incentives or STI bonus, next to the salary and long-term incentives are one of the three main compensation elements for the executives and individuals whose work is key to the company strategy.

They are granted to the employees for the achievement of the short-term goals whose performance period is equal to or less than one year. Typically those are annual, quarterly, or monthly periods. Short term incentive plan is a formal scheme that details the conditions, amounts, and schedule in which the STI bonus is received.

The main benefit of the short-term incentive plan is to align the employee's goals with the company's short-term strategy. Because of that, short-term incentive plan has traditionally been an important part of executive compensation. In recent years, however, an increasing number of organizations has used STI bonus as a part of their talent attraction and retention strategy, mainly by granting annual bonuses to a much broader spectrum of employees.

The overwhelming majority of the short-term incentive plan come as cash, but some companies also reward their employees with stocks or options. Currently, a short-term incentive plan is the most common form of incentive pay - 89% of companies have at least one.

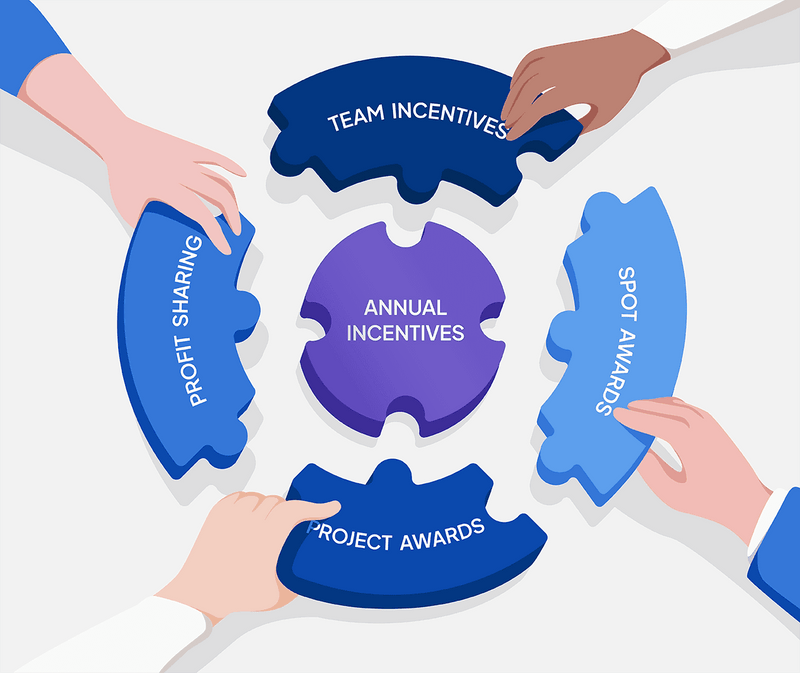

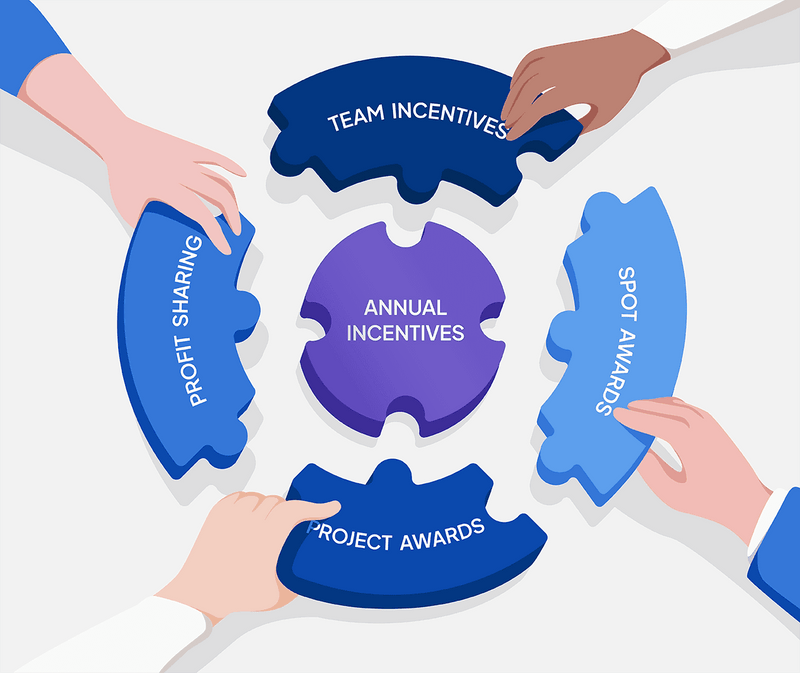

These are awards granted every year to the individual employee for the achievement of the predetermined strategic objectives.

An executive pay plan at JP Morgan Chase is a good example. Short-term incentives comprise 40% of the top management's variable income, are entirely based on the employee performance, and the payout is determined the year following the performance period. Also, the bonuses come as 100% cash awards.

Employers award discretionary bonuses at their sole discretion. It's an award employees' don't expect, and its timing, requirements, and amounts are not disclosed in advance. Because of that, unlike the annual incentive plan, the discretionary bonus is not a motivator. Those types of awards have a predetermined size of the bonus pool, there is no formal plan in place, and grants are not guaranteed. In other words, the company decides to reward its employees after the fact.

Profit sharing plan allows employees to participate in an organization's profits.

For example, the European InPost rewards its management with short-term incentive plan that is 50% cash and 50% deferred into company shares for three years - a quasi vesting schedule. This sort of STI is modeled on long-term incentives.

Similarly, HSBC's executives in 2021 received annual incentives, half in the form of cash awards and half in immediately vested shares subject to one year retention period.

Spot award is usually a small cash or non-monetary reward that provides immediate recognition to certain employees for their exceptional performance or contributions to a specific project or task. Usually not previously determined.

Grants are given to individuals or groups for the fulfillment of a specific task or project, where the requirements and amounts are typically known upfront.

Team incentives reward group performance as well as encourage effective collaboration.

Annual incentive plan for all the named executive officers at Beyond Meat, except the CEO, tracks solely corporate metrics to foster teamwork among the C-suite and emphasise the company-wide performance.

The main benefit of a short-term incentive plan is to align the goals of the employees with those of the company. 93% of surveyed companies list alignment as the primary purpose behind offering STI bonuses.

This is particularly important if your organization has pressing business priorities that need to be enacted in a relatively short time. By setting targets and metrics strongly correlated with those needs, you encourage your key employees to prioritize those goals.

Just keep in mind to carefully weigh the individual targets against each other as well as those in long-term incentives so that the long-term strategy is protected for the fulfillment of the short-term goals.

A strong focus on short-term incentives can be particularly helpful to companies wanting to quickly correct for several concerns at once, such as post-merger adjustments, acquisitions, or unexpected changes in market conditions i.e., due to the Covid-19 pandemic or supply chain problems.

The introduction of short-term incentives motivates the management to carefully consider the most sensitive as well as opportunity-laden areas within the company strategy. The targets and metrics, especially with monthly and quarterly performance periods, provide a quick pulse regarding the progress. And measuring performance during shorter periods is much simpler compared to long-term incentive awards that take years to complete.

For example, the STI bonus plan at Beyond Meat runs with quarterly performance cycles and disbursements to encourage the achievement of the goals and close monitoring of progress in the face of the Covid-19-related market conditions turmoil.

Clear goal setting with additional motivating factors such as cash awards in short-term incentive plan substantially boost employee performance. Targets show your workers which tasks they should focus on and encourage them to do those tasks in the most effective ways.

Short-term incentive awards work particularly well for middle and lower management as well as highly-skilled professionals, as they direct them to focus their efforts on goals that may not have been otherwise obvious to them.

According to the WillisTowersWatson 2023 survey, 94% of companies struggled with attracting talent this year, and 89% had difficulties retaining their employees. Although the surveyed firms expect that those problems won't be as severe in 2023, still more than half believes that they will have to deal with retention issues.

On the other hand, from the employee perspective, pay and bonus are the top reasons workers stay at their current job (39%) or decide to change their employer (56%). A short-term incentive plan especially offered also to employees outside of the executive group, is a great way to entice them to stay with the company.

Companies know that. At this point, around half of companies offer a short-term incentive plan to nonexempt employees, and 96% to the exempt salaried and executives.

According to researchers from the MIT Sloan School of Management, failure to recognize employee performance is almost three times more predictive of attrition than compensation.

High-performing employees are usually passionate achievers who value various forms of appreciation and recognition. Offering both formal and informal forms of recognition may be one of the easiest ways to retain your key employees and build strong company culture.

Short-term incentives such as spot awards, discretionary bonus plans, and team incentive programs are great ways to strengthen non-monetary praise with financial benefits.

In order for the short-term incentive program to have a positive impact on the organization, the targets and metrics need to be carefully considered. Remember that the award recipients will put most of their effort into fulfilling those goals at the expense of others. If your targets, metrics, or weights are not aligned with the organization's strategy, the short-term incentives may do more harm than good to the company-wide performance.

Your employees need to understand the short-term incentive plan in order for it to be effective. Confused or ambiguously defined goals may result in employee focusing their efforts on a different area than expected. Also, STI bonuses trying to meet all the possible goals of the company also make no sense since the focus becomes blurred. Communicating goals clearly assure the achievement of the objectives.

So how does a short-term incentive plan look in practice?

Here is an example of how a company from the Energy sector used short-term incentives to improve the health, safety, and service delivery standards,

The main goal of the STI plan: The improvement of service delivery standards and betterment of health & safety culture:

To achieve this goal, an engineering company from the energy sector decided to focus on a short-term incentive plan for the executives and senior managers, setting three goals shared across the entire company, both for technical and support units, in order to ensure that all the organizational units work together to optimize and streamline their operations. All the shared goals were equally weighted. Short-term incentives formed the significant component of the compensation package - up to 50%-60% annually on target.

At the beginning of each year, the company set numerical targets for two technical measures, reflecting failure-free operations: the annual number of minutes of installation downtime and the number of serious failures during the year. The parameters for all serious failure types were clearly defined.

The third shared goal was health & safety standards. The measures of the goal described particular activities required to be completed by each manager during the year, regardless of whether working on-site or in the office. Additionally, in the case of a fatal accident, the result of the health & safety goal was missed for all the managers across the entire company.

The outcomes were measured against thresholds, allowing to receive 200% of the target when performance was over expectations. Please note that for all the goals mentioned above, the satisfactory outcome meant a lower value than expected; therefore, the curves have been inverted.

The plan also covered 3-4 individual goals set for each manager, and a certain level of economic profit was the trigger for the bonus payout.

To view in detail actual short-term incentive plans, read my analysis of the executive compensation at the leading public companies.

Short-term incentives are the most popular form of compensation after salary. They are a must-have for management and rare-skills positions at most public and private organizations. Now, they are becoming a major part of executive compensation at nonprofit and government agencies.

According to CapThinking Incentive Pay Practices Survey, in 2021, short-term incentive plans prevalence at nonprofits reached record highs, with 82% of the organizations offering an STI bonus. Government organizations are following suit, with 58% introducing short-term incentives, a 14% rise compared to 2019. We can expect that trend to continue, with more and more institutions of this sort adopting them in the future.

As inflation has become a worldwide concern in recent months, many companies have begun to look for ways in which they can alleviate the erosion of compensation for their employees. Some introduced second or third salary reviews. Yet, that may only be feasible for some, as many compensation departments already struggle with their capacity, and the budgets of many firms may not allow for two to three permanent raises per year.

Hence, quite a few firms turn to discretionary bonuses to offset inflation. These typically come in the form of 2-5% one-time cash grants or merit-based spot awards.

During the times of acute labor shortages employers began to explore new ways to reward their talent. In addition to merit, project completion, and performance-based awards, some companies started to offer competency grants as part of their total rewards. This means that based on the individual's seniority and experience, higher-level workers are eligible for larger and more frequent incentives.

For example, a junior developer may not receive any bonuses, but a regular may get a short-term incentive plan, and a senior-level developer, in addition to a short-term incentive plan, may receive other types of annual bonuses. This strategy helps firms focus on the retention of key individuals as well as encourages more junior people to move up the experience ladder.

As the public pressure for responsible business practices finally pushed the environmental and social concerns to the mainstream debate, ESG metrics started to pop-up in various incentive programs. In fact, 83% of the US and EU senior executives surveyed by Navex believe that ESG factors impact the brand's reputation.

By now, as many as 75% of EU firms and 59% of US companies use ESG metrics in their STI bonus plans. The numbers are much smaller for long-term incentives. This is because of annual incentives' shorter performance cycle, which lends itself to more frequent checks and adjustments. Since ESG metrics are, at this point, somewhat of a novelty for most companies, their incorporation in short-term incentive plans offers a much more agile approach.

Rekha Gurnani Chowdhury

Head of Compensation & People Analytics at Box

And, according to the experts, in the coming years we can only expect ESG and DEI goals to proliferate. "I expect to see DEI goals becoming a greater focus in the future, with clear targets such as representation percentages, and pay equity metrics, especially as pay transparency legislation changes in the US. ESG will also start to become a greater focus, especially in certain industries," predicts Rekha Gurnani Chowdhury, Head of Compensation & People Analytics at Box.

Short performance cycles, large flexibility and variety make short-term incentive plan a pretty much a must-have in the current economic state. Granting the changing conditions and unpredictability of the labor market, the STI bonus is a valuable tool each company should use to its benefit. Carefully designed, short-term incentives will not only retain your employees but also help to advance the strategic goals by aligning your employees with that of the company, improving their performance and recognizing them for their efforts.

Find out how you can optimize your short-term incentives management.