Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

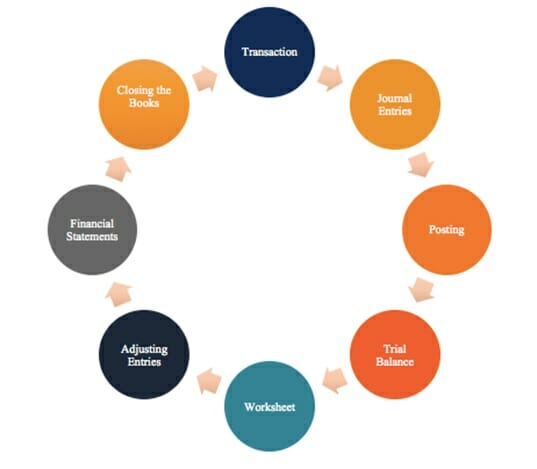

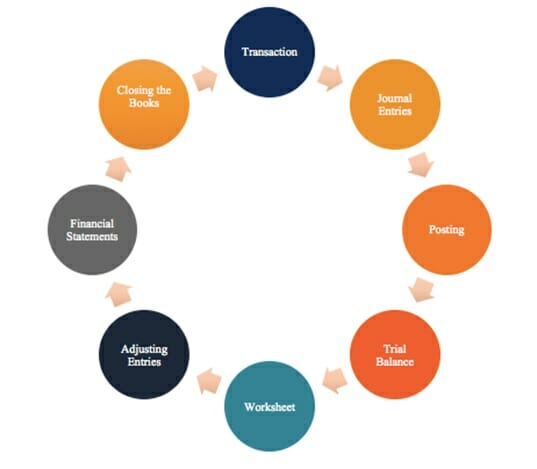

The accounting cycle is the holistic process of recording and processing all financial transactions of a company, from when the transaction occurs, to its representation on the financial statements, to closing the accounts. One of the main duties of a bookkeeper is to keep track of the full accounting cycle from start to finish. The cycle repeats itself every fiscal year as long as a company remains in business.

The accounting cycle incorporates all the accounts, journal entries, T accounts, debits, and credits, adjusting entries over a full cycle.

Transactions: Financial transactions start the process. If there were no financial transactions, there would be nothing to keep track of. Transactions may include a debt payoff, any purchases or acquisition of assets, sales revenue, or any expenses incurred.

Journal Entries: With the transactions set in place, the next step is to record these entries in the company’s journal in chronological order. In debiting one or more accounts and crediting one or more accounts, the debits and credits must always balance.

Posting to the GL: The journal entries are then posted to the general ledger where a summary of all transactions to individual accounts can be seen.

Trial Balance: At the end of the accounting period (which may be quarterly, monthly, or yearly, depending on the company), a total balance is calculated for the accounts.

Worksheet: When the debits and credits on the trial balance don’t match, the bookkeeper must look for errors and make corrective adjustments that are tracked on a worksheet.

Adjusting Entries: At the end of the company’s accounting period, adjusting entries must be posted to accounts for accruals and deferrals.

Financial Statements: The balance sheet, income statement, and cash flow statement can be prepared using the correct balances.

Closing: The revenue and expense accounts are closed and zeroed out for the next accounting cycle. This is because revenue and expense accounts are income statement accounts, which show performance for a specific period. Balance sheet accounts are not closed because they show the company’s financial position at a certain point in time.

The general ledger serves as the eyes and ears of bookkeepers and accountants and shows all financial transactions within a business. Essentially, it is a huge compilation of all transactions recorded on a specific document or in accounting software .

For example, if you want to see the changes in cash levels over the course of the business and all their relevant transactions, you would look at the general ledger, which shows all the debits and credits of cash.

To fully understand the accounting cycle, it’s important to have a solid understanding of the basic accounting principles. You need to know about revenue recognition (when a company can record sales revenue), the matching principle (matching expenses to revenues), and the accrual principle.

The fundamental concepts above will enable you to construct an income statement, balance sheet, and cash flow statement, which are the most important steps in the accounting cycle. To learn more, check out CFI’s free Accounting Fundamentals Course.

Thank you for reading CFI’s guide on the Accounting Cycle. To keep learning and advancing your career, the following resources will be helpful: