The Arizona lease agreement is a contract that is fulfilled when a landlord (lessor) would like to grant a tenant (lessee) the right to reside within their property in return for a monthly fee. There are several different lease agreements available that vary in the type of property being rented, length of the term, and provisions set forth within the document. The lessee will typically be requested to complete a rental application before they are accepted as a viable candidate to rent/lease the desired property.

Rental Application – Given upon request, a rental application will allow for the landlord to view the history of an applicant to ensure they are a good candidate to lease a rental property. The documentation provides information on the possible tenant such as name, address, employer, monthly income, and social security number to run necessary background checks.

Commercial Lease Agreement – For properties where the tenant plans to locate their business/company.

Lease to Own Agreement – Also known as an “Option to Purchase”, this document provides the tenant with the opportunity to buy the property as long as they correspond with the conditions set forth within the agreement.

Month-to-Month Lease – This agreement allows a lessee to rent the property for one month at a time. Either party may terminate the lease after each month, although thirty (30) days notice (prior to the next payment’s due date) is required by law (§ 33-1375(B)).

Roommate Agreement – Is provided by a tenant who is listed on the lease to an individual interested in renting a room within the property.

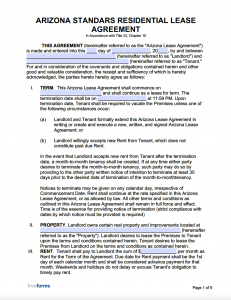

Standard Lease Agreement – Confirms the particulars of the contract to grant the right of use of a residential unit to a lessee.

Sublease Agreement – If permitted within the original lease, the tenant may use this contract to rent the property to a third party.

Refer to the Arizona Residential Landlord and Tenant Act for more information about the general provisions put forth by the state in regard to the lessor/lessee relationship.

Bed Bug Control (§ 33-1319) – It is required that the landlord provide the tenant with an educational pamphlet containing useful information about the pest and how to avoid an infestation.

Landlord and Tenant Act (§ 33-1322(B)) – The lessor must provide the lessee with a copy of the Act or notify them in writing that it can be found on the Arizona Department of Housing’s website.

Lead-Based Paint (42 U.S. Code § 4852d) – Lessor is required by federal law to provide a disclosure of information regarding any lead-based paint and/or lead-based paint hazards contained within the premises (if the property was built before 1978).

Marijuana Use Policy ( § 36-2813) – A landlord is prohibited from the refusal to lease to an individual for the reason of he or she being a medical marijuana cardholder. Any policies concerning the use of marijuana should be disclosed prior to signing.

Move-in Checklist ( § 33-1321(C)) – A document that notes any damages/defects that may be contained within the property prior to the tenant moving in, which protects them from incurring any fees for damages they are not responsible for. (Landlord must attach this form to the lease agreement.)

Non-Refundable Fees (§ 33-1321(B)) – All charges that may not be redeemed by the lessee must be stipulated within agreement prior to tenancy.

Proprietor Information (§ 33-1322(A)) – The individual who is authorized to enter into the rental agreement must provide a written disclosure to the tenant that contains the names & addresses of any of the following that apply:

Rent Increase Due to Taxes ( §33-1314(E)) – If a local ruling adjusts the tax percentage on residential rent transactions, the landlord may increase the tenant’s payment to compensate for the higher tax rate. In order to do this, the landlord must first provide a written disclosure within the lease agreement stating that they have the right to increase the rent under these circumstances. (Thirty (30) day’s written notice is required before any changes can take effect.)

Shared Utilities (§ 33-1314.01) – Within the lease agreement, the landlord must include a full list of all the utility services that are billed individually and also clarify the cost of any administrative fees that are connected to submetering or the use of a ratio utility billing system.

Arizona law does not contain a statute that specifies a set grace period for residential properties, although they do allow 5 days for manufactured homes. The tenant must provide the rent payment on the date in which both parties agreed upon and recorded within the lease.

There is no decree that dictates the amount of a late fee for a residential dwelling (manufactured homes have a limit of $5 per day). Rental late fees should be stipulated within the lease agreement prior to the commencement of the tenancy.

There is no fee enforced by law in regard to a bounced check provided by the tenant. The landlord may include a provision within the agreement calling for a fee no greater than $25 as well as reimbursement for any charges imposed by their bank for processing the check.

The limit amount a lessor can demand as a security deposit in Arizona is one and a half (1.5) month’s rent (§ 33-1321(A)). That being said, this statute does not prevent the tenant from willingly providing a payment in advance that exceeds that total.

Once the lease has expired and the tenant has vacated the premises, the landlord has fourteen (14) days (not including weekends & holidays) to return the security deposit via first class mail (§ 33-1321(D)). They must include an itemized list that notes any deductions subtracted from the remaining funds. If the tenant disagrees with any of the charges, they have sixty (60) days from the time they received the list to dispute the overall assessment.

The lessor must provide the lessee with a minimum of two (2) days of advanced notice before accessing the property (§ 33-1343(D)).